As we know nowadays everything has gone digital. No one goes to offline stores to buy products anymore. We are jumping on e-commerce sites because it is easy to shop for the best offers and prices in online stores.

We can get all our liked products at affordable prices. The product can be of any price, it can be priced at Rs 10 or Rs 1 lakh, and we never step back to order that product from the online store. But sometimes customers face problems buying some expensive products and they prefer to buy the product in installments instead of full payment. Also, in this digital age, you cannot manage all online changes using the SBI DEBIT card only

This is the situation where  SBI credit cards come into play. A credit card enables an online buyer to buy things in instalments. You can also go offline shopping and use credit cards if you are running out of cash.

Let us first understand whether you should apply for an SBI credit card online or not by studying the pros and cons of credit cards

Pros and Cons of Credit Cards

Pros-

- No interest up to a certain period for repayment

- You can pay the amount in EMIs with a small interest on online products like TVs, Mobiles, Bikes, etc

- Users are generally allowed to withdraw money generally 35%-40% of the credit limit of their bank

- You may avail loan using a credit card from the bank provided you have a good record of credit repayment and a high credit standing

- Free Air miles and usage of the lounge at airports and reward points for your spending.

- You can get the best and jaw-dropping offers/discounts on the credit card for many products and services

Cons-

- Access to debt can lead to debt if your expenditure goes beyond your repayment capacity.

- The interest rates of credit cards may reach up to 40%

- If you have any of the dues then your credit score will be affected and you won’t get any loans in future

- If your credit card is lost and there is no insurance on your credit card then you are liable to pay for any transactions that occur after losing the card.

- When you default on credit card payments, you are charged late fees and interest, increasing your debt load.

- So, friends, you understand the pros and cons of using credit cards.

- Now come to our main topic How to apply for an SBI credit card online.

You can check the bank balance of your bank account using the official missed call numbers

ELIGIBILITY CRITERIA FOR CREDIT CARD APPLICATION

| AGE (MINIMUM AND MAXIMUM) | 21 YEARS AND 60 YEARS |

| MINIMUM INCOME | VARIES FOR DIFFERENT CREDIT CARDS (GENERALLY, Rs 20,000) |

| PROFESSIONAL EMPLOYMENT | Â SALARIED OR SELF-EMPLOYED |

| OTHER ELIGIBILITY CRITERIA | SHOULD HAVE REGULAR SOURCE OF INCOME |

| SHOULD HAVE A GOOD CREDIT SCORE AND SHOULD NOT HAVE DEFAULT PAYMENTS |

The applicant must check the following CRITERIA

AGE – Maintaining a Credit card is not easy sometimes, so SBI has set a certain age range. It gives banks assurance that their credit cardholders can pay their credit card bill at the right time. At the time of applying for a credit card, the State Bank of India observes that the minimum age of the applicant is 21 years and the maximum age of the applicant is predetermined by the bank. ( not to exceed 60 years).

MINIMUM INCOME – The credit card holder must have a regular monthly income that must meet the minimum income criteria as defined by the State Bank of India. The minimum criteria for different credit cards may vary.

CREDIT HISTORY – The credit history or credit score of the applicant should be quite good as it shows the regularity and responsibility of the applicant. A credit score must be above average to avail credit card facility.

DOCUMENTS AND NATIONALITY –

- The requirements of documents may vary as per SBI guidelines according to the different occupations of the applicant

- Applicant must be a resident or non-resident Indian.

Use this SBI referral code and get an amount of upto ₹150 for YONO users and ₹5000 for SBI credit card holders

REQUIRED STEPS FOR ONLINE SBI CREDIT CARD APPLICATION

USING WEBSITE –

- Visit the official website of SBI credit card-sbicard.com

- On this page, click on the credit cards

- After clicking it, scroll down a bit to see our premium credit card written below.

- Under this many categories are present like

- Lifestyle cards

- Reward cards

- Shopping cards

- Travel and Fuel cards

- Banking partnership cards

- Business cards

- All cards-Where cards from all the categories are present

- From these select the card according to your requirement. Carefully read every detail of each card to know the offers, usage, interest rates, off during use, etc.

- Click on the apply button of your chosen card to proceed further

- The next step is to fill up the details like Name, place, DOB, Qualifications, etc

Note-If you already have an SBI credit card and login details then all the details will be filled out automatically and you will be asked to give your credit card number in the next step. And all the steps will be completed within a couple of minutes

- In the occupation field, if you choose a salaried person, verification is faster than other options.

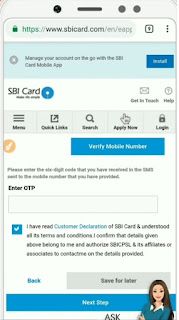

- After filling in all the details like PAN number and Phone number, you will receive OTP and put it to verify your mobile number

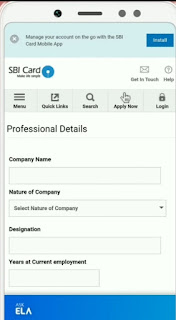

- After verification of your mobile number, you will be asked to fill in professional details such as gender, PIN code, and professional details (professional details are only asked if you have selected a salaried person).

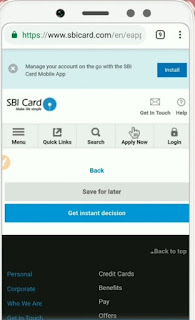

- Tick the checkbox to accept terms and conditions and click on Get instant decision

- Wait for some time until all your details and documents are verified by SBI (correct PAN card, address, phone number, etc.)

- You can get 1-2 calls if necessary or agents can travel to you to verify manually

- If everything is found right, you will get your credit card within 2-3 weeks

USING SBI YONO APPS

- Download and install the YONO SBI APP from the playstore or Appstore

- Open the YONO SBI app to log in or signup

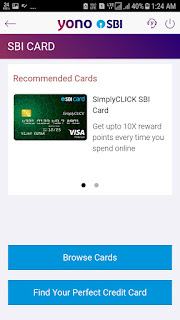

- Tap on the Cards

- Move to Get a new SBI card

After this, there will be 2 options

- Browse a card

- Find your perfect credit card

- If you choose to Browse a card then you will be shown different types of credit cards according to the categories. Each credit card has its own specifications

- If you choose to Find your perfect credit card, then you will be asked certain questions just to simplify the card selection process.

- After this, you have to fill in all the necessary details for different widows. All the processes are exactly the same as the website procedures

- After all these steps you will receive an application number message and customer care will contact you to verify your application

- You will receive the SBI credit card at your home address within 10-20 days

Note – It has been seen that if you apply for the SBI credit card using the YONO SBI app, then your verification process is completed quickly and you get approval for your SBI credit card.

Conclusion

So, friends, I have tried my best to cover all the topics related to the topic like How to apply for an SBI credit card online and get instant approval including the pros and cons of credit cards. If you have any queries, then comment below, and I will solve your problems for sure.