The Complete Guide to the Cryptocurrency Mining World

In this digital era, everything is turning to be digital. Now in the digital industry, it is possible to do anything that you were doing physically before. Similarly, physical currencies have also changed their form to virtual currencies so-called cryptocurrencies.

And surprisingly cryptocurrency mining is somehow similar to gold mining however differs only in the respect that both have separate processing techniques, demand, and supply.

I know you all are aware of cryptocurrencies. Nowadays terms like bitcoin,ethereum, Ripple, and Zcash are common to all. And most of you also know what these terms mean.

But have you ever thought about how all cryptocurrency transitions work? How a receiver receives cryptocurrency from the sender without any delay? What makes bitcoin users use bitcoin with trust?

Friends, to understand such queries you need to understand every concept related to its transition system. let me explain to you from scratch. Most cryptocurrencies involve blockchain technology.

After understanding this, you will understand the whole cryptocurrency mining process. Although I don’t think everyone is familiar with this Blockchain technology. Ya, obviously some of you know this term. but keeping in mind all of you as a new learners, let’s start from scratch.

What is Blockchain technology?

The blockchain is an electronic distributed ledger that is completely open to anyone. That means if you are sending a bitcoin to your friend then I will have the power to access the details of this transition.

Unlike the traditional banking system, all the transitions that are being operated using blockchain technology are not controlled by any centralized authority.

All the transition records are processed with high security, transparency, and complex mathematical calculations. One of the interesting properties of the blockchain is that you cannot change the data after entering the block.

Now let’s know What is a Block in cryptocurrency mining.

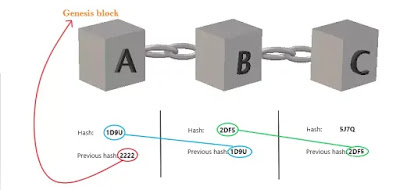

Block is a permanent file of data that stores all details related to blockchain transitions. Each block contains some data, the hash of the block, and the hash of the preceding block. A block stores both past reports and new transitions recorded at the current time.

A hash is a unique code that is specific to each block. Any change in information causes changes to the hash of the block.

This refers to the number of cryptocurrencies generated when a miner finds the solution. This number started at 50 Bitcoins back in 2009 and is halved every 210,000 blocks, in about four years.

The current number of Bitcoins awarded per block is 12.5. The last block halving occurred in July 2016 and the next one will be in 2020.

The data stored inside a block varies according to the different blockchains. For example in the case of the bitcoin, it stores information about the sender, receiver, and number of bitcoin used in the transition

I know there will be a little bit of confusion but…

Ok let me visualize you by taking an example

Here you can see a chain of 3 blocks. As you can see, each block has a hash and the hash of the previous block. So block number C points to block number B and number 2 points to number A.

Now the first block is a bit special, it cannot point to previous blocks because it’s the first one. We call this the genesis block.

Now let’s say that you tamper with the second block. This causes the hash of the block to change as well.

In turn that will make block 3 and all following blocks invalid because they no longer store a valid hash of the previous block.

So each time a block is solved(completed) after hashing, it gets connected to the previous block by carrying information on both past transitions and new upcoming blocks.

Thus this block becomes part of the past and is added to the blockchain. This completed block is now a permanent record of past transactions and all the upcoming information of another new block will be stored in this current block.

Similarly, that new block will get passed after hashing and will again get added to the blockchain by keeping the record of previous ones and allowing the next block to record its data.

Here let me tell you the first block cannot point to previous blocks. This first block is named as genesis block as it cannot connect to its preceding block.

Now if you try to alter in the second block, then the hash of the block will also change.

This, in turn, will make block 3 and all following blocks invalid as they no longer store a valid hash of the previous block.

So changing a single block will make all the following blocks invalid. But the use of hashes is not enough to prevent tampering.

Computers are very fast these days and can calculate hundreds of thousands of hashes per second. You can change a block effectively and recalculate all hashes of the following blocks

So to mitigate this, blockchains have something called proof-of-work.

I will explain what is this Proof-Of-Work in detail later in this post.

But for the sake of quick understanding let me tell you its literal meaning

Basically, Proof-Of-Work is a mechanism that slows down the creation of new blocks.

In Bitcoins case: it takes about 10 minutes to calculate the required proof-of-work and add a new block to the chain.

This mechanism makes it very hard to tamper with the blocks because if you tamper with 1 block, you’ll need to recalculate the proof-of-work for all the following blocks.

So creative use of hashing and the proof-of-work mechanism gives more security to blockchain technology.

But there is one more way that blockchains secure themselves and that’s by getting distributed.

Instead of using a central entity to manage the chain, blockchains use a peer-to-peer network and get distributed by allowing anyone to join. When someone joins this network, he gets a full copy of the blockchain.

The node or miner can use this to verify that everything is in order and fine or not. So when someone creates a new block that new block is sent to everyone on the network.

Each miner then verifies the block to make sure that it hasn’t been tampered with in any form.

If everything is correct, each miner adds this block to its own blockchain.

All the miners in this network create a consensus and agree about what blocks are valid and which aren’t. Blocks that are tampered with will be rejected by other miners in the network.

Friends, I think you would have got some rough ideas about the entire cryptocurrency transition process. Now let’s come to our main topic What is cryptocurrency mining and how it work?

What is cryptocurrency mining?

If you have read all the points properly so far, Then I think you would have known some rough concepts of cryptocurrency mining.

Cryptocurrency mining is the process of validation of cryptocurrency transition. Since blockchain technology is operated by a decentralized network, so instead of any regulatory authority, all the transition is validated by solving thousands of complex mathematical problems that decrypt the block codes.

This process of solving the problem requires huge computing power. Generally, GPUs and specialized mining hardware like ASICare used as hardware for decrypting the code.

So GPU miners are those individuals or companies that use all the hardware, and software, create space to set up these things, pay heavy electricity fees, etc.

Miners use their computers and other hardware setups to verify the transitions and ensure they are not false.

Here the main mining process begins where all the miners try to guess a random number that solves an equation generated by the system.

Sounds simple, right?

Of course, this guessing is all done by your computer. The more powerful of a computer you have, the more guesses you can make per second, thus increasing your chances of winning this game.

If you managed to guess right – you earn Bitcoins and get to write the “next page†of Bitcoin transactions on the blockchain. The one who solves the complex problem of the block is rewarded with some cryptocurrency created by the network

The amount to be rewarded may vary based on how much hardware contributed to decrypt and verify the code.

If you want to know about bitcoin read my post here- What is bitcoin?

Let’s understand cryptocurrency mining in detail by taking the example of Bitcoin.

Bitcoin was created as a decentralized alternative to the banking system. Once your mining computer comes up with the right guess, your mining program determines which of the current pending transactions will be grouped together into the next block of transactions.

Compiling this block represents your moment of glory as you have now become the temporary banker of Bitcoin who gets to update the Bitcoin transaction ledger known as the blockchain.

The block you’ve created, along with your solution is sent to the whole network so other computers can validate it. Each computer that validates your solution updates its copy of the Bitcoin transaction ledger with the transactions that you chose to include in the next block

As you can imagine, since mining is based on a form of guessing; for each block, a different miner will guess the number and be granted the right to update the blockchain.

Of course, the miners with more computing power will succeed more often, but due to the laws of statistical probability, it is highly unlikely that the same miner will do so every time.

After this stage is complete, the system generates a fixed amount of Bitcoins and rewards them to you as compensation for the time and energy you spent solving the math problem.

Additionally, you get paid any transaction fees that were attached to the transactions you inserted into this block.

So that’s Bitcoin mining in a nutshell. It’s called mining because of the fact that this process helps “mine†new Bitcoins from the system.

But if you think about it, the mining part is just a by-product of the transaction verification process.

So the name is a bit misleading since the main goal of mining is to maintain the ledger in a decentralized manner.

But it is not as easy as you think. The inventor of Bitcoin Satoshi Nakamoto crafted the rules for mining in a way that the more mining power the network has, the harder it is to guess the answer to the mining math problem.Â

So the difficulty of the mining process is actually self-adjusting to the accumulated mining power the network possesses.

If more miners join, it will get harder to solve the problem; If many of them drop off, it will get easier. And this is known as the mining difficulty.

So why on earth did Satoshi do this? Well, he wanted to create a steady flow of new Bitcoins to the system. In a sense, this was done to keep inflation in check.

The mining difficulty is set so that on average a new block will be added every 10 minutes. Now, remember, this is on average.

We can have two blocks added minute after minute and then wait an hour for the next block. In the long run, this will even out to 10 minutes on average.

When Bitcoin first started out there weren’t a lot of miners out there. In fact, Satoshi, the inventor of Bitcoin, and his friend Hal Finney were some of the few people mining Bitcoin back at the time with their own personal computers.

Using your CPU, meaning your Central Processing Unit or your computer’s brain, was enough for mining Bitcoin back in 2009 since the mining difficulty was low.

As Bitcoin started to catch on people looked for more powerful mining solutions. Gradually people moved to GPU mining.

A GPU or Graphics Processing Unit is a special component added to computers to carry out more complex calculations. GPUs were originally intended to allow gamers to run computer games with intense graphics requirements.

Because of their architecture, they became popular in the field of cryptography and around 2011 people also started using them to mine Bitcoins.

For reference, the mining power of one GPU equals that of around 30 CPUs. Another evolution came later on with FPGA mining.

FPGA is a piece of hardware that can be connected to a computer in order to run a set of calculations. They are just like a GPU, but 3 to 100 times faster.

The downside is that they are harder to configure, which is why they aren’t as commonly used in mining as GPUs.Â

Finally, around 2013 a new breed of miner was introduced – the ASIC miner. ASIC stands for Application-Specific Integrated Circuit, and these were pieces of hardware manufactured solely for the purpose of mining Bitcoin.

Unlike GPUs, CPUs, and FPGAs they couldn’t be used to do anything else. Their function was hardcoded into the machines.

ASIC miners are the current mining standard. Some early ASIC miners even appeared in the form of a USB but they became obsolete rather quickly.

Even though they started out in 2013 the technology quickly evolved and new more powerful miners were coming out every 6 months.

Since 2016 the pace at which new miners are released has slowed considerably. Now that you know what miners are.

Now let us know What is Proof-of-Work and Proof-of-Stacks in the mining world.

Origin and concept of proof-of-work

As we know cryptocurrency mining takes a lot of computing power because of the proof-of-work algorithm. This idea of proof-of-work was first introduced in 1993 to combat spam emails and was formally called “proof-of-work†in 1997.

However, the technique went largely unused until Satoshi Nakamoto created Bitcoin in 2009. He realized that this mechanism could be used to reach a consensus between many nodes on a network and he used it as a way to secure the Bitcoin blockchain.

However, the proof-of-work algorithm works by having all the nodes solve a cryptographic puzzle. This puzzle is solved by miners and the first one to find the solution gets the miner reward.

This has led to a situation where people are building larger and larger mining farms like this one.

According to Digiconomist, Bitcoin miners alone use about 54 TWh of electricity, enough to power 5 million households in the US or even power the entire country of New Zealand or Hungary.Â

But it doesn’t stop there. Proof-of-work gives more rewards to people with better and more equipment. The higher your hash rate is, the higher the chance that you’ll get to create the next block and receive the mining reward.Â

To increase chances even further, miners have come together in what’s called “mining poolsâ€. They combine their hashing power and distribute the reward evenly across everyone in the pool.

If the pool manages to win the competition, the reward is spread out between the pool members depending on how much mining power each of them contributed.Â

So to sum it up: proof-of-work is causing miners to use massive amounts of energy and it encourages the use of mining pools which makes the blockchain more centralized as opposed to decentralized.Â

So to solve these issue we have to find a new consensus algorithm that is as effective or better than proof-of-work

Origin and concept of proof-of-stack

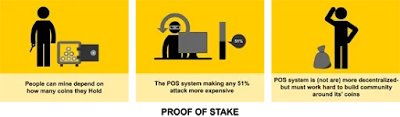

In 2011 a Bitcointalk forum user called QuantumMechanic proposed a technique that he called “proof-of-stakeâ€. The basic idea is that letting everyone compete against each other in mining is wasteful.

So instead proof-of-stake uses an election process in which 1 node is randomly chosen to validate the next block.

Proof-of-stake has no miners but instead has “validators†and it doesn’t let people “mine†blocks but instead “mint†or “forge†blocks.

They are not selected at random. To become a validator, a node has to deposit a certain amount of coins into the network as a stake. You can think of this as a security deposit. The size of the stake determines the chances of a validator being chosen to forge the next block. It’s a linear correlation.

Let’s say Sonu deposits $1000 dollars into the network while Monu deposits $100. Monu now has a 10 times higher chance of being chosen to produce the next block. This might not seem fair because it favors the rich, but in reality, it’s fairer compared to proof-of-work.

With proof of work, rich people can enjoy the power of economics at scale. The price they pay for mining equipment and electricity doesn’t go up in a linear fashion. Instead, the more they buy, the better the prices they can get.

Okay, but how can we trust other validators on the network?

Well, that’s where the stake comes in. Validators will lose a part of their stake if they approve fraudulent transactions. As long as the stake is higher than what the validator gets from the transaction fees, we can trust them to correctly do their job. Because if not, they lose more money than they gain.

If a node stops being a validator, his stake plus all the transaction fees that he got will be released after a certain period of time.

Differences between Proof-of-work and Proof-of-stake

Proof-of-stake doesn’t let everyone mine for new blocks and therefore uses considerably less energy.

It’s also more decentralized. How is that? Well in proof-of-work we have something called mining pools. Those are people who are teaming up to increase their chances of mining a new block and thus collecting the reward.

However, these pools now control large portions of the bitcoin blockchain. They centralize the mining process and that’s dangerous. If the three biggest mining pools would merge together, they would have a majority stake in the network and could start approving fraudulent transactions.

Another important advantage is that setting up a node for a proof-of-stake based blockchain is a lot less expensive compared to a proof-of-work based one.

Is cryptocurrency mining profitable?

Cryptocurrency mining actually profitable today?†Well, the short answer is “probably notâ€, the correct (and long) answer is “it depends on a lot of factorsâ€.Â

When calculating mining profitability there are a lot of things you need to take into account. What type of cryptocurrencies you are choosing to mine?

It may be Bitcoin, Ethereum, Litecoin, Monero, Zcash. The Hash Rate refers to your miner’s performance or how many guesses your computer can make per second.

This refers to the number of cryptocurrencies generated when a miner finds the solution. This number started at 50 Bitcoins back in 2009 and is halved every 210,000 blocks, in about four years.

How many dollars are you paying per KiloWatt? You’ll need to find out your electricity rate in order to calculate profitability.

This can usually be found on your monthly electricity bill. The reason this is important is that miners consume electricity – whether for powering up the miner or for cooling it down as these machines can get really hot.

Each miner consumes a different amount of energy. You’ll need to find out the exact power consumption of your miner before calculating profitability.

This can be found easily with a quick search on the Internet or through this list. Power consumption is measured in Watts.

If you’re mining through a mining pool, and you should, then the pool will take a certain percentage of your earnings for rendering their service.

Since no one knows what cryptocurrencies’ prices will be in the future it’s hard to predict if mining them will be profitable.

If you are planning to convert your mined Bitcoins in the future to any other currency, this variable will have a significant impact on your profitability. And finally the Difficulty increase per year – This is probably the most important and elusive variable of them all.

The idea is that since no one can actually predict the rate of miners joining the network, neither can anyone predict how difficult it will be to mine in 6 weeks, 6 months, or 6 years from now.

Once you have all of these variables at hand you can insert them into a cryptocurrency mining calculator and get an estimate of how much cryptocoins you will earn each month.

If you can’t get a positive result on the calculator it probably means you don’t have the right conditions for mining to be profitable.

Types of Cryptocurrency Mining

I assume by now you have pretty much knowledge about CPU and GPU mining. But you may have also heard about other types of mining like cloud mining, mobile mining, or even web mining.Â

Cloud mining means that you do not buy a physical mining rig but rather rent computing power from a mining company and get paid according to how much mining power you buy.

At first, it seems like a very good idea because you don’t have to go through all the trouble of buying expensive equipment, storing it, cooling it and monitoring it.

However, in reality, none of these cloud mining sites are profitable. In fact, there are some scams that don’t own any mining equipment, they just fool you and run away with your money.

Mobile mining mobile apps are there to mine Bitcoin on your phone. But the problem is phones with less processing power than ASIC miners will likely drain your phone’s battery much faster and in turn, be able to make a very small portion of one bitcoin.

The apps that allow this, act as mining pools for mobile phones and distribute earnings according to how much work was done by each phone.Â

Remember, mining is possible with any old computer, it’s just not worth the electricity wasted on it since the slower the computer, the smaller the chances of actually getting some kind of reward.Â

Web mining- Finally, somewhere around 2017, the concept of web mining came to life. Simply put, web mining allows website owners to hijack, so to speak, their visitors’ CPUs and use them to mine Bitcoin.Â

This means that a website owner can make use of thousands of “innocent†CPUs in order to gain profits. However, since mining Bitcoins isn’t really profitable with a CPU, most of the sites that utilize web mining mine other coins instead.Â

From the site owner’s perspective, web mining has become a new way to monetize websites without the need for placing annoying ads.

Also, the site owner can control how much of the visitor’s CPU he wants to control in order to make sure he’s not abusing his hardware.

Many companies are moving their mining operations to countries that have an excess of electricity. This means that the use of electricity worldwide is actually becoming more efficient.

Final thoughts

Hopefully, now you have a better understanding of what cryptocurrency mining is – the process of updating the ledger of cryptocurrency transactions incentivized with the reward of new Bitcoins to those who participate. You can know the uses of blockchain and crypto In the NFT market

You may still have some questions. If so, just leave them in the comment section below.